Background

The MSME Digital Financial Inclusion Project’s overall goal is to support the development of a Regional Digital Retail Payments Platform that serves Micro Small and Medium Enterprises (MSMEs) in COMESA Region thereby improving cross border trade.

CBC is implementing a Digital Financial Inclusion (DFI) programme that supports the design, development and deployment of an integrated regional digital retail payment scheme that is low-cost, interoperable and fraud resistant that serves Micro Small and Medium sized Enterprises (MSMEs), for the COMESA region. The program has a keen focus on women and youth.

This will evolve from a regulatory focus approach to the business model, to actual operational and technical establishment, with clearly defined components.

EXPECTED IMPACT

Financial inclusion

participation of MSMEs in regional trade

Increased volumes of cross border transactions

Increased visibility of African products within regional markets

Directly respond to the intra-trade deficit in the region.

Key project Objectives

To develop a compelling value proposition for public and private stakeholders

including regulators, on an instant low value payments infrastructure, that facilitates transactions in real time, and safely regardless of who they choose as the financial services provider, their location and time of the day.

To support the design, development and deployment of an integrated digital financial services Infrastructure

(regulatory and modelling) that is low-cost, interoperable and fraud resistant that serves MSMEs and the customers they transact with at the bottom of the financial pyramid

To establish a digitally inclusive regional payment scheme

that lowers transaction costs for MSMEs, and the majority are women for whom growing, making and selling food, products and services are the means to survive

To streamline cash-based MSMEs into digital markets

that enjoy affordable, interoperable, transparent, real-time financial transactions.

To increase volumes of cross border transactions

financial inclusion and the participation of MSMEs in regional trade.

To develop capacity building

of the Regional digital retail payment platform

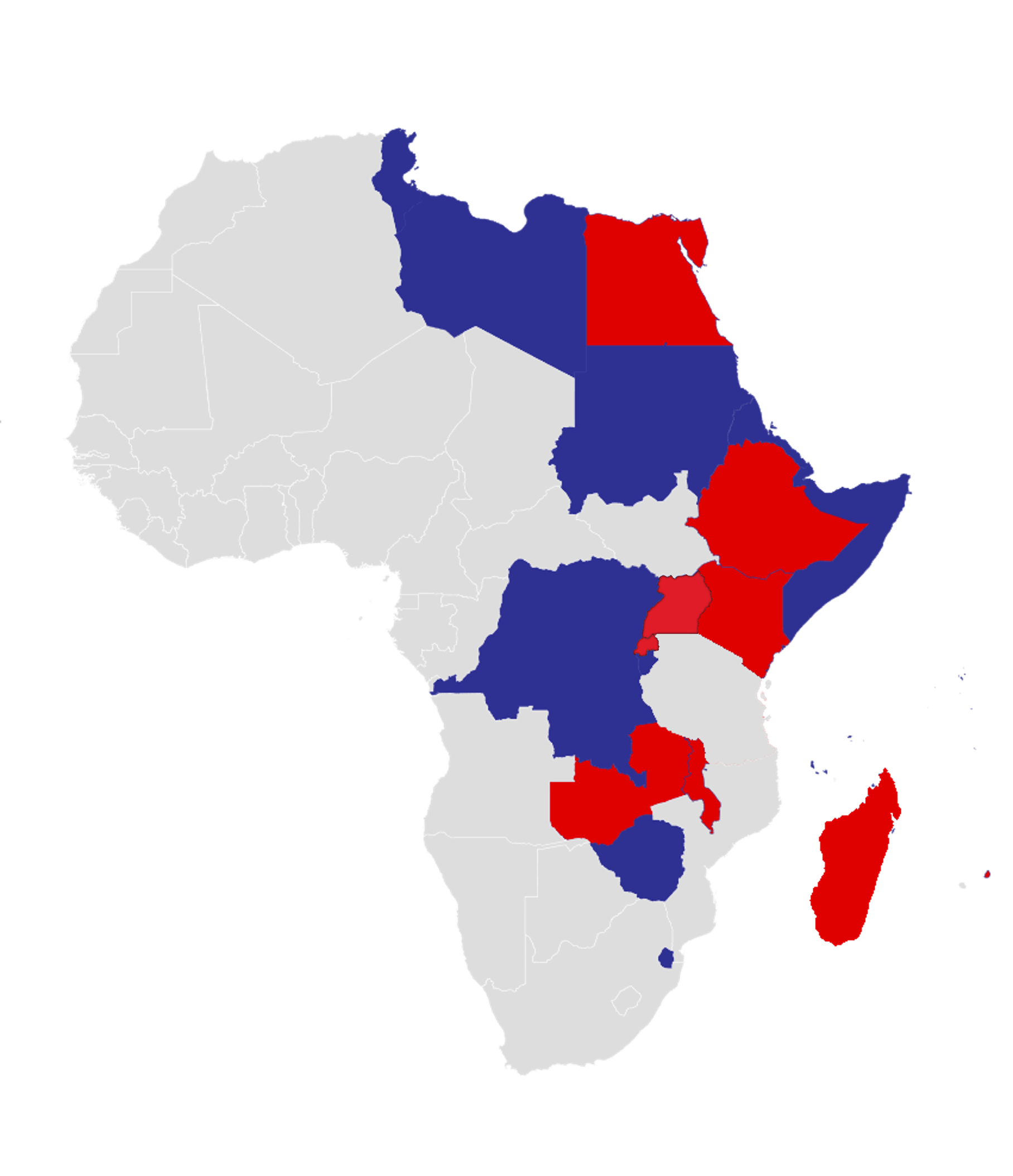

Piloted project in 8 of the 21 COMESA Member States.

Kenya, Uganda, Rwanda, Mauritius, Egypt, Ethiopia, Malawi, and Zambia

Status of Key Project Outputs

Business Case Development

Business Case & Model Policy development completed & validated.

PPD: 20th – 21st Jan 2021

Policy Framework

Validation of Model Policy completed. PPD: 27th July 2021

Business Model

First validation of Business Model completed.

PPD: 3rd Dec 2021

Technical Capacity Building

7 Technical Capacity Building Modules for MSMEs developed

Digital Retail Payments Platform for MSMEs

Final validation of Business Model. PPD: 10th March 2022

Achievements

1. Business Case study

2. Model Policy Framework

3. Business Model

4. Draft Regulation guidelines (Rule book)

5. Capacity Building

6. Stakeholder collaborations

7. Publications

8. Political Will

Publications

BUSINESS MODEL ON OPERATION AND IMPLEMENTATION OF THE REGIONAL DIGITAL RETAIL PAYMENT SCHEME FOR MSMEs IN COMESA

Level One Design Principles

The following proposed level one principles are taken into account in the scheme design.

1

Real-time, Push Payments

2

Open-loop/

Interoperable System

3

Irrevocable Payments

4

Same-Day Settlement

5

Pro-Poor Governance

6

Government Support/ Regulatory Oversight

7

Cost-Recovery Based/ Low Cost Payments

8

Shared Fraud Service

9

End User Experience

10

Appropriate Technology

12

Use Cases Drive Scale

13

Enabling Programs and User Education

Operations Management Team

Chief Executive Officer

Coordinates the Advisory Committee and the Operations Management

DFI Advisory Committee

Airtel, Vodacom, BPR Bank Rwanda Plc, Bank of Zambia, Kenya Bankers Association, Bankers Association of Zambia, Bayer, Coca Cola, Technobrain Group, RISA, COMESA Clearing House

Chief Operating Officer

Lead in managing the administration, overall project activities/technical implementation, event management, financial reporting, monitoring and evaluation.

Chief Information Officer

Establishing and advancing existing digital services capacity efforts for the stakeholders-industry, regulators, partners, secretariat.

Business Development and Participants Manager

Design, research and implement program activities to respond to demand driven requirements in the project from stakeholders.

Marketing and Product Innovation Manager

awareness, advocacy, knowledge management, manage communications and stakeholder engagements, quality control of project outputs.